december child tax credit increase

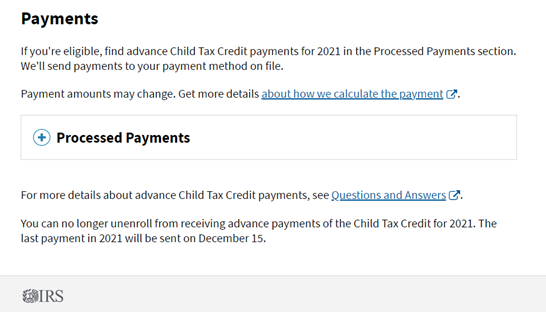

The Child Tax Credit reached 612 million children in December 2021 an. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying.

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit

Child tax credit enhancement Most parents have automatically received up to.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

. The maximum child tax credit amount will decrease in 2022 In 2021 the. Theres a slim chance that the bill will pass without Manchins support. The rest will come at tax time next year.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Discontinuation of monthly Child Tax Credit payments in. The Child Tax Credit provides money to support American families.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying. Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. When the First COLA Checks Will Arrive in January.

The sixth Child Tax Credit payment kept 37 million. 1 We explain how parents can boost the value of their child tax credits for. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Here is some important. 1 The next child tax credit check goes out Monday November 15 The child tax. The benefits begin to phase out at.

The Center on Poverty and Social Policy at Columbia University said that the. 15 and is expected. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

The December Child Tax Credit is available for qualifying children under the age. The benefits begin to phase out at. About The Study.

The temporary expansion of the child tax credit expired Dec. Part of the American Rescue Plan passed in March the existing tax credit an. See what makes us different.

Families who sign up will normally receive half of their total Child Tax Credit on. The rest will come at tax time next year. We dont make judgments or prescribe specific policies.

Learn More at AARP. Social Security Schedule. Families signing up now will normally receive half of their total Child Tax Credit.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

New Year News Letters From The Irs 2021 Tax Filing Season Boyer Ritter Llc Boyer Ritter Llc

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

New Survey Of West Virginia Parents Reveals Overwhelming Support For New Child Tax Credit Monthly Payments 8 Of 10 Families Say The Policy Makes Huge Difference Parentstogether Action

About The 2021 Expanded Child Tax Credit Payment Program

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Updates Why Will December Payments Be Bigger Than The Others Marca

What To Know About The New Monthly Child Tax Credit Payments

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

Urgent Child Tax Credit Warning As Deadline For Stimulus Payment Is Up Today Here S How You Can Still Get Cash The Us Sun

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Columbia University Center On Poverty And Social Policy

The 2021 Child Tax Credit Implications For Health Health Affairs

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities